For businesses looking for an upgrade in financial management, the highly anticipated release of Microsoft Dynamics 365 Business Central is no doubt a cutting-edge advancement for cloud-based ERP solutions available to, and built for, small-to-medium sized businesses. The Business Central finance module offers diverse and robust functionality, including general ledger, allocations, reconciliations, payment handling, fixed assets, and bank account management – to name just a few.

Also, in the utility line up are Account Schedules, a tool used directly inside the Business Central application for standard and custom financial reporting. As controllers, accountants, bookkeepers, and CFOs address their needs for “getting data out,” many are left with questions on if Account Schedules will be enough, and how they compare to Jet Reports Financials, the first, and currently only, third party financial reporting solution built for Business Central and available in AppSource.

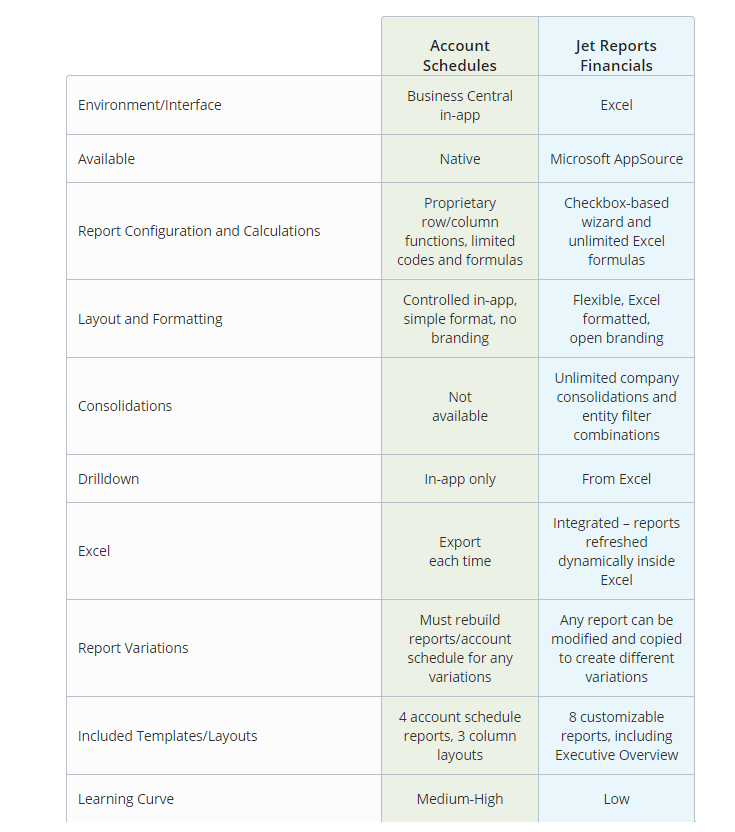

In this post, we are going to provide a general overview and cover the differences between Account Schedules and Jet Reports Financials by looking at the main components and distinctions between these two solutions through: configuration, formatting/report layout, consolidations, templates, and a high-level comparison chart.

What are Account Schedules?

Account Schedules are used to get visibility into the financial chart of accounts data that resides inside Business Central in order to obtain reports like income statements, balance sheets, or cash flows. Account Schedules aren’t as new as Business Central itself. Since Business Central is built from Microsoft Dynamics NAV, those who are familiar with or have had experience with NAV may know how to use Account Schedules already. Account Schedules are accessed and used directly inside the Business Central application, so it relies on propriety code, layout, and formulas for creating reports.

Business Central delivers some sample account schedules, so you can use those templates or set up your own rows and columns. For example, you can create account schedules to calculate profit margins on dimensions like departments or customer groups. While you can create as many account schedule financial statements as you want, Account Schedules are confined to being inside Business Central unless, or until, manually exported to Excel using an export option.

What is Jet Reports Financials?

Jet Reports Financials is a third party reporting solution built for Microsoft Dynamics 365 Business Central that provides a simple and easy way to create and run financial reports directly inside of Excel. This delivers an interface much more familiar to finance professionals, where they are often exporting or copying and pasting. Don’t misinterpret the “third party” label though. Jet Reports Financials is available in Microsoft AppSource, where Dynamics 365 in-app integrations go through rigorous testing and vetting by Microsoft before being authorized for availability. Which means you can be confident that this reporting solution has top level performance and it addresses a need from Business Central users. Jet Reports Financials is also built by and from the same Jet Reports solutions relied on by over 154,300 Microsoft Dynamics users globally.

From directly in Excel, Jet Reports Financials brings the ability to drag-and-drop any combination of chart of accounts, dimensions, and companies to instantly see account balances and create financial statements in the format users want. This brings with it the benefit of maximizing resources, decreasing risk, and lifting Business Central’s native reporting limitations by giving users the ability to build reports on their own without technical expertise, eliminating manual reporting tasks, and extending visibility on financial data.

Comparing Accounts Schedules and Jet Reports Financials:

Configuration:

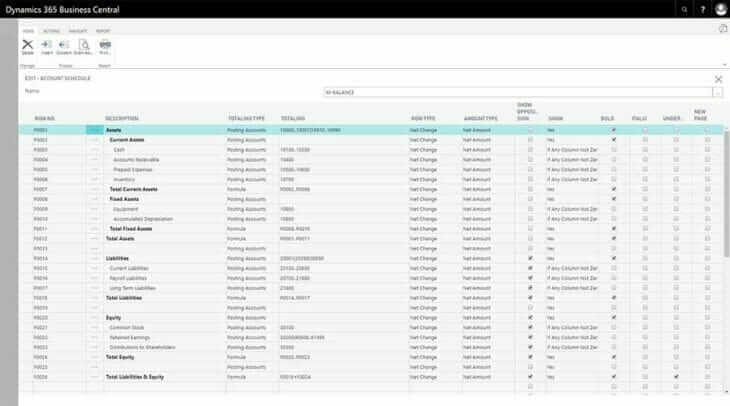

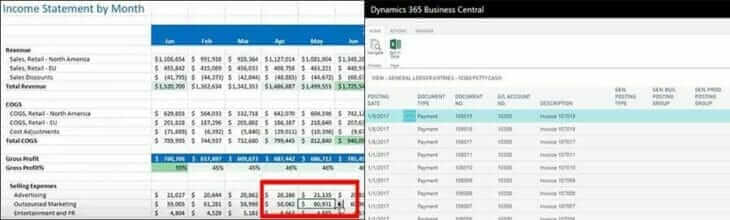

When using Account Schedules in Business Central, a user must understand how to define both the row and the column layouts. The row layouts are specific to each account schedule and the column layouts can be created and reused with different account schedules. Not only is there a learning curve with this, mistakes can be hard to troubleshoot and result in unexpected numbers being displayed in the report. Here is an example of what is required to configure rows in an account schedule:

In addition, to show anything other than just the net change, a user will need to create a number of column definitions. This involves using proprietary formulas. For example:

- <Blank> = Current period

- -1P = Previous Period

- -1FY[1..LP] = Entire previous fiscal year

- -1FY[CP..LP] = From current period in previous fiscal year to last period of previous fiscal year, inclusive

There are more of course, but you get the idea. This isn’t the most intuitive approach to report writing.

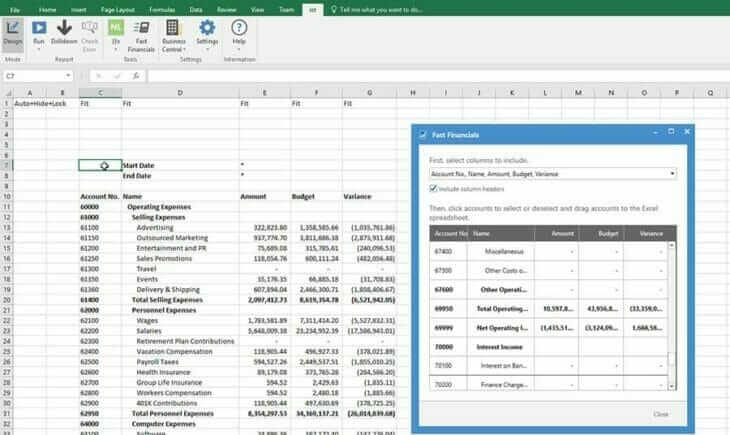

Alternatively, with Jet Reports Financials, users can simply put the accounts in the rows that they want and use the familiar Excel date formatting, functions and formulas they already know to build out column headings and perform calculations that will dynamically update every time a report is refreshed to the real-time data from Business Central.

Check out this video to see how reports are easily set-up in Jet Reports Financials.

Report Layout:

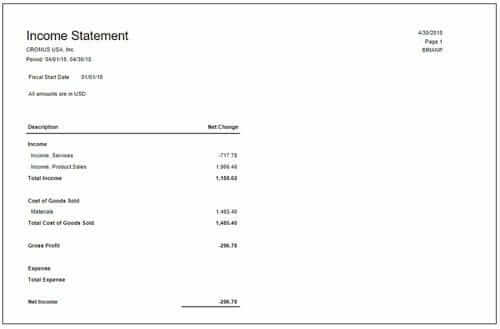

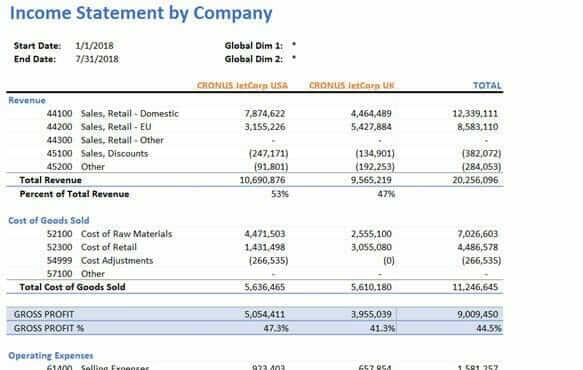

Within Business Central’s Account Schedules, there is quite a bit of limitation in terms of how you can make the report look. There is no way to do things like add a logo, for example. Many users will end up running their account schedule, exporting it to Excel, and then spending needless time each month to format it and make it look appropriate for distribution to business stakeholders. Here is an example of the standard income statement that ships with Business Central:

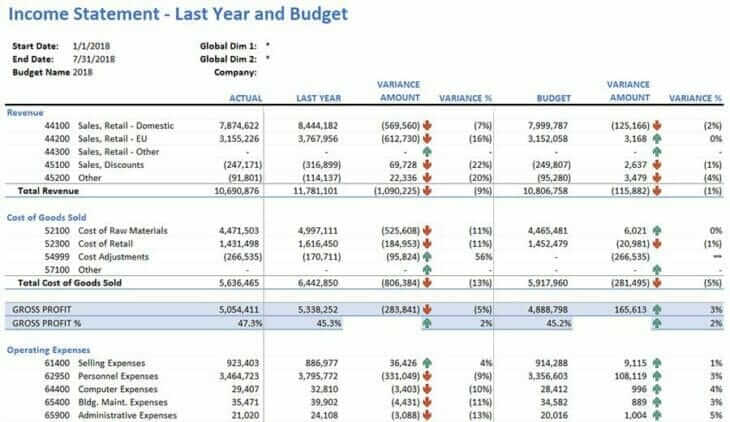

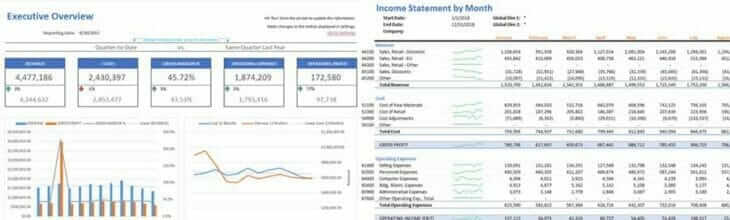

With Jet Reports Financials, all of the formatting is handled inside of Excel so any logos, corporate color schemes, charts, PivotTables, and account layouts are just as easy to include or apply as any spreadsheet. This even allows users to get scorecard or dashboard type report formats and summaries of the financial data. Plus, the formatting only needs to be created and applied once. The report can then be easily re-run or refreshed on demand and all the formatting will remain or dynamically update, as the case would be with charts or graphs.

Drilldown:

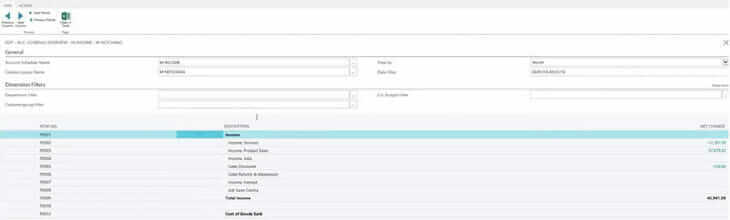

Although drilldown is available on an account schedule when it’s inside Business Central, Account Schedules do not support drilldown from Excel. As is evident by the current use of Account Schedules in Dynamics NAV, most companies are going to need to export their account schedule to Excel, in order to format it appropriately. Once it’s there, users won’t have the ability to get back to the numbers and details that compose the report.

With Jet Reports Financials, the functions used to build the report in Excel fully support drilldown and drill-back to the Business Central web client. So, users can click a number on a monthly income statement, for example, and immediately get directly to the transaction details that make up this number.

Consolidations:

Account Schedules in Business Central are composed per company and limited to these individual entities. There is no way to do one account schedule across multiple companies without a dedicated consolidated company set up in Business Central. Doing this requires a ton of extra development work and maintenance, for the sheer purpose of consolidated financial reports. Not only does this introduce unnecessary added costs, it introduces risk in that consolidated company being accurate, and decreases the flexibility of the consolidation output. For example, you would always have to run the report for all the companies at once, you could not parse them out.

Jet Reports Financials, on the other hand, seamlessly allows consolidations across any combination of company entities, without the need to set-up a consolidation company in Business Central. This is imperative for any organization running multiple companies in Business Central because it enables the flexibility to produce the financial consolidations required.

Templates:

Account Schedules deliver a few sample, standard reports and column layouts in Business Central. You can change some filters applied to them, such as dates/periods, department, standard dimensions or budget and change the column layout and calculations used. Remember, account schedules are driven by defined row/column layouts. You can modify these templates by adding new rows, but it’s important to note that you cannot copy the account schedule templates, or any account schedule for that matter, and make different variations:

Standard account schedules:

- Balance Sheet

- Cash Flow Statement

- Income Statement

- Retained Earnings

Standard column layouts (that will affect the report results):

- Periods

- Balance

- Net Change

Jet Reports Financials delivers 8 standard, modifiable reports out-of-the-box. This includes some reports that cannot be created with native Business Central reporting. All the template reports within Jet Reports Financials are completely customizable, and like any other report created with Jet Reports Financials, they can be copied an indefinite number of times to create unlimited variations. This capability has an extreme time saving advantage from Account Schedules, where you must completely start from scratch each time you want at new variation of a report, costing users hours of time and productivity.

Standard Jet Reports Financials Reports:

- Executive Overview and Scorecard

- Trial Balance

- Expenses by Dimensions

- Income Statement by Company

- Income Statement Last Year and Budget

- Income Statement by Month

- Balance Sheet

- Cash Flow Statement

Comparison Chart:

Here is a high level comparison chart of Account Schedules vs. Jet Reports Financials for Microsoft Dynamics 365 Business Central:

Even though Microsoft Dynamics 365 Business Central is certainly a step ahead in cloud-based business management, it isn’t immune to the long legacy of ERP solutions across nearly every platform in a lack of delivering flexible and easy-to-use financial reporting out-of-the-box. Microsoft doesn’t disappoint on providing a user friendly and robust system for putting the business data “in” and enforcing operational and financial processes, but continues its tradition in relying on third-party options for the ability to deliver best of breed technology in areas like reporting.

Jet Reports Financials offers accurate answers in a more flexible format to increase reporting efficiency. When implementing or moving to a new ERP like Business Central, it’s important to prioritize, giving finance users the reporting and data intelligence tools they need to effectively reduce risks, boost visibility, and get the answers at a moments’ notice. Best of all, there is absolutely zero risk in trying it out.